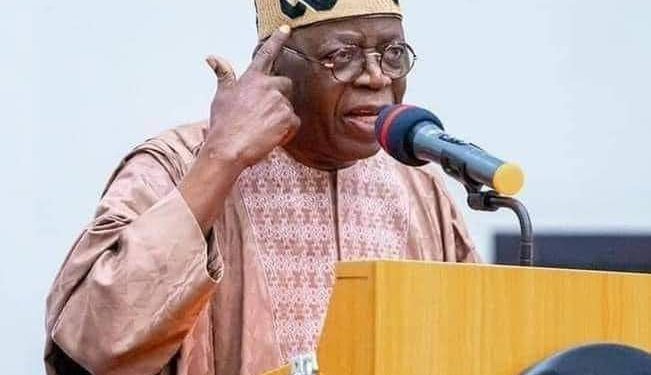

One of the key assumptions underlying President Bola Tinubu’s 2025 budget is an inflation rate of 15 percent. While many agree inflation may decline in 2025, this target appears overly optimistic given the current economic landscape.

Inflation has been a persistent problem in Nigeria, reaching unprecedented levels since Tinubu took office in May 2023. Over the past 18 months, the rising cost of goods and services has outpaced income growth, largely due to his economic policies, including the removal of fuel subsidies and the floating of the naira.

By November 2024, inflation surged to a 28-year high of 34.6 percent, compared to 28.2 percent in November 2023. This rise has been driven by various factors, such as increased food and transportation costs, higher housing and utilities expenses, poor infrastructure, insecurity, low agricultural output, soaring energy prices, and rising input costs for manufacturers.

The 70 percent devaluation of the naira since May 2023 has further worsened the situation, causing the prices of imported goods to triple in an economy heavily reliant on imports. Food inflation also climbed to 39.9 percent in November 2024.

Even before Tinubu’s reforms, inflation stood at an already elevated 22.7 percent in May 2023. This was driven by monetary and fiscal inefficiencies, structural economic issues, exchange rate instability, rising food prices, and low foreign direct investment (FDI) inflows.

However, projections from key institutions present a more cautious outlook. The World Bank estimates that inflation in Nigeria will decline to 14.3 percent by 2027, assuming ongoing macroeconomic reforms are sustained. Meanwhile, the African Development Bank forecasts an inflation rate of 20.7 percent, and Fitch Ratings projects 26.2 percent by the first quarter of 2025.

Achieving the ambitious target of 15 percent inflation by 2025 will require addressing several significant challenges.

The Nigerian economy remains heavily reliant on crude oil exports, which contribute over 90 percent of foreign exchange earnings. Although oil production improved to 1.8 million barrels per day by November 2024 due to reduced oil theft, global oil prices remain volatile.

The country’s limited industrial capacity and dependence on imports for essential goods, including food and manufactured products, continue to strain the naira. Efforts by the Central Bank of Nigeria (CBN) to unify exchange rates have made limited progress, with gaps persisting between official and parallel market rates due to foreign currency shortages, speculation, and weak export earnings.

Exchange rate volatility drives up import costs, complicating inflation control efforts. Meanwhile, the CBN’s aggressive monetary policies, including six interest rate hikes in 2024, have raised the benchmark interest rate to 27.5 percent—an increase of 875 basis points.

Despite these measures, an excessive money supply undermines progress. Broad money reached a record N109 trillion in September 2024, reflecting a 62.8 percent year-on-year increase from N66.94 trillion in September 2023. Without addressing this liquidity surplus, inflation-targeting efforts are unlikely to succeed.

Fiscal challenges further complicate the situation. The 2025 budget projects a deficit of N13.08 trillion, amounting to 26.3 percent of total expenditure and 3.89 percent of GDP. Additionally, N15.81 trillion, or 45 percent of projected revenue, is earmarked for debt servicing, underscoring Nigeria’s severe fiscal constraints.

Tax reforms are essential to improving revenue generation and must be implemented swiftly. Alongside this, the government must exhibit greater fiscal discipline to minimize wasteful spending.

Attracting foreign direct investment is also critical to controlling inflation. According to Ayo Teriba, CEO of Economic Associates, Nigeria’s inflation rate could drop to 5 percent by 2025 if the country attracts $50 billion in FDI. Such inflows would strengthen the naira, stabilize exchange rates, and improve key macroeconomic indicators.

To achieve sustainable inflation control, Nigeria must address its structural economic challenges. Investments in infrastructure, including power supply, roads, and ports, are essential to support economic diversification. Additionally, addressing insecurity and boosting agricultural productivity will play a key role in fostering long-term economic stability.